Offering Transparency & Trust

We know that the cost of affording your loved one’s senior living experience can sometimes seem overwhelming, or even out of reach. We’re here to help.

We understand that having complete peace of mind is a priority. We aim assure our clients that their financial resources are being managed effectively. We take pride in providing easy-to-understand information that gives you the tools needed to make the best choice for your family.

If you have any questions, please reach out to us and we’d be more than happy to help.

What the Monthly Cost Covers

Every community we manage uses an inclusive cost structure that covers almost everything from rent, utilities, and meals all the way to maintenance and housekeeping. Plus, there are no real estate taxes to worry about.

After crunching the numbers, you might even discover that living in a Bridge community is quite comparable to non-community experiences—all without the chores and upkeep of home ownership.

Financing Your Loved One’s Stay

When you’re deciding the best way to fund life at Bridge Senior Living, there are lots of options worth exploring.

Some financial strategies you might consider include:

- Disbursements from personal retirement and pension plans

- Equity from the sale of your home

- A bridge loan or home equity loan

- Veterans Affairs Aid and Attendance benefits for veterans or their surviving spouses

- Sales of stocks and securities

- Life settlement income or cash from the sale of mature insurance policies

- Private funding from companies such as Elderlife Financial Services, which specializes in senior living loans

Above all else, we want to make sure that the experience you or your loved one has is the best it can be. If you have any questions regarding financing, please reach out.

Get in Touch Today

Contact us for any questions about senior living, our communities, or financial opportunities.

We’re here to provide expert advice and help you make the right decision for you and your family.

Lifestyle Plus

Independent Living Apartments & Villas

It’s your time. Enjoy the active, independent lifestyle you love without the worry. Make time for your passions, from fitness to social engagements, great food, and good friends.

Short-Term Stays

We offer short-term stays for those in need of temporary support or who want to experience our communities before moving in.

Assisted Living

The hospitality and lifestyle you’ve come to appreciate combined with compassionate care and support from certified professionals.

Lilac Trace Memory Care

Connection and belonging are at the heart of memory care. Our certified dementia practitioners create a supportive space that allows our residents to thrive.

The Bridge Difference

Purposeful Wellness

Embrace a life of wellness with our comprehensive range of programs that include fitness, therapy, and pharmacy services. Experience the difference of compassionate wellness support, offered by our dedicated caregivers.

Chef-Prepared Dining

We understand the importance of a good meal. Our culinary program is directed by executive chefs who are passionate about every detail, from taste and nourishment to service and experience.

Events & Experiences

Take a painting class, visit local museums and galleries, or participate in our lifelong learning programs. Our events and experiences provide numerous avenues for fun and fulfillment.

Connection & Community

Social connection is intrinsic to our health and happiness. Be part of a community and maintain a thriving sense of physical, emotional, and mental well-being.

Find a Community

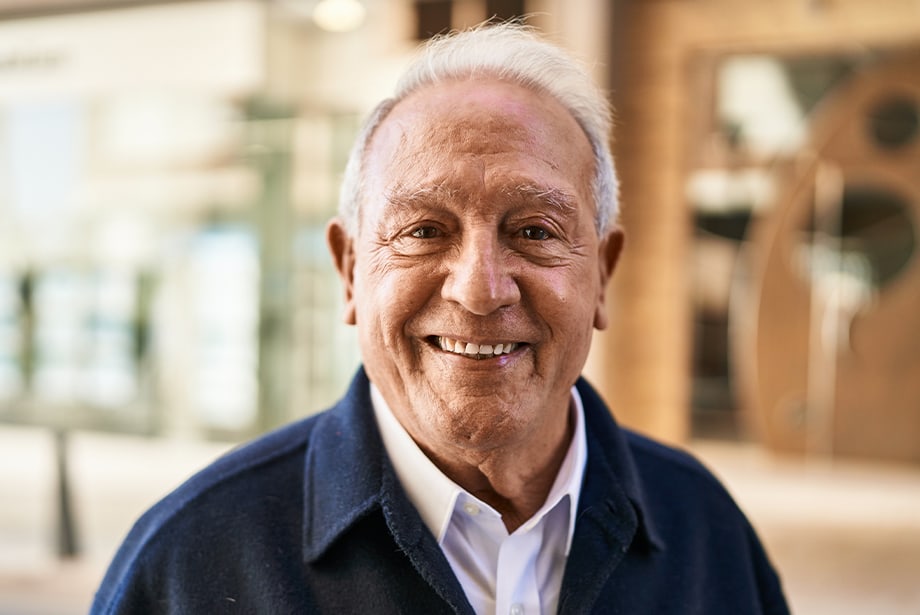

Hear what Others are Saying

See why our residents and loved ones chose to make a Bridge Senior Living Community their home.

About Us

The BSL Differences

Resources

Find Us

- 1000 Legion Pl., Suite 1600

- Orlando, FL 32801

- Phone: 1-888-883-1796

- Email: questions@bridgeseniorliving.com